How Home Equity Can Help Fuel Your Retirement in San Antonio, Texas

If retirement is on the horizon, now’s the time to start planning your next chapter. Ensuring financial security is crucial so you can enjoy the lifestyle you desire in your golden years.

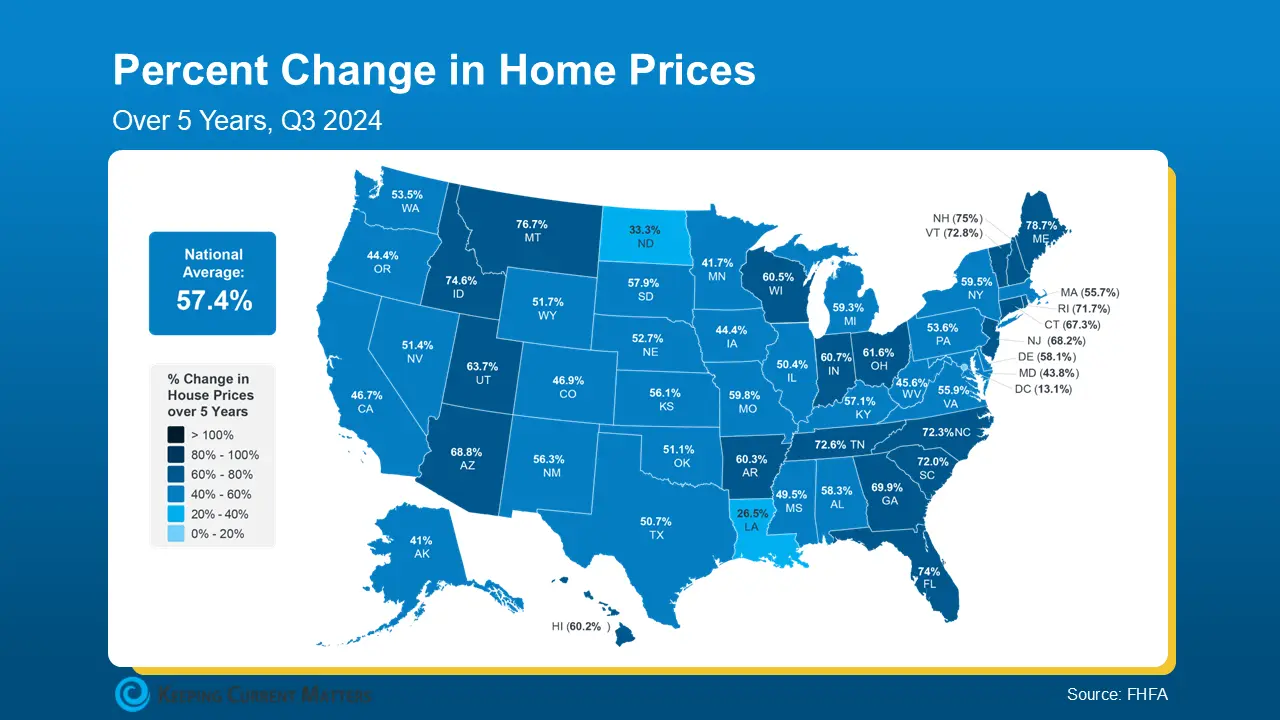

What many homeowners in San Antonio don’t realise is that they may be sitting on a hidden financial asset—their home. According to data from the Federal Housing Finance Agency (FHFA), home values have increased nearly 60% in the last five years alone (see graph below):

This increase in home values has significantly boosted homeowners’ net worth. According to Freddie Mac, in the same five-year period:

“Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

If you’ve owned your home for even longer, you likely have even more equity built up. This makes now a great time to consider selling your home and downsizing to maximize your retirement funds.

Why Downsizing in San Antonio Might Be the Right Move

Selling your current home and moving into a smaller, more affordable property—or even relocating to a more budget-friendly area like Boerne, TX—could allow you to leverage your home equity for a more comfortable retirement.

Whether you want to travel, spend more time with family, or simply feel financially secure, downsizing can provide you with the extra funds to achieve your retirement goals. As Chase Bank states:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Benefits of Downsizing in San Antonio

1. Lower Cost of Living

-

o According to Data from the AARP, the number one reason adults 50 and older move is to reduce their cost of living. Downsizing to a smaller home or relocating to a more affordable suburb like Boerne or New Braunfels can help lower expenses such as property taxes, utilities, and maintenance costs.

2. Simplify Your Lifestyle

-

A smaller home means less upkeep and fewer responsibilities, allowing you to spend more time on hobbies, travelling, or enjoying the San Antonio lifestyle.

3. Increase Financial Flexibility

-

Selling your current home and tapping into your equity allows you to pay off debt, invest, or create a financial cushion. You could even buy your next home in cash, eliminating the burden of a mortgage

Finding the Right Realtor in San Antonio

If you’re considering downsizing, working with an experienced San Antonio real estate agent is key. A knowledgeable realtor can:

- Assess your home’s equity and market value.

- Help you find a new home that fits your retirement goals.

-

Navigate the selling process smoothly, ensuring you get the best return on your investment.

Bottom Line

If you’re planning to retire in 2025, now is the perfect time to downsize and unlock your home’s equity. With San Antonio’s affordable housing market and vibrant communities, moving to a smaller home can help you maximise your retirement lifestyle.

Connect with the Gahm Real Estate Team today to start planning your next move and make every day feel like a Saturday!

FAQ

1. How can I use my home equity for retirement?

You can access your home equity by downsizing, taking a cash-out refinance, using a home equity loan, or opting for a reverse mortgage. Selling and moving to a smaller home is a popular way to free up funds for retirement.

2. Is downsizing a good option for retirement?

Yes! Downsizing can lower your cost of living, reduce maintenance, and provide extra cash from your home equity to support your retirement lifestyle.

3. Can I buy my next home in cash using my home equity?

If you have enough equity, selling your current home could allow you to purchase your next home outright—eliminating mortgage payments and increasing financial security.

4. What are the best places to retire near San Antonio?

Popular retirement-friendly areas include Boerne, Fair Oaks Ranch, New Braunfels, Alamo Heights, and Helotes, offering affordability, great amenities, and easy access to healthcare.

5. What’s the first step to selling my home and unlocking my equity?

Start by consulting a local real estate expert to assess your home’s value, explore your selling options, and find the best downsizing opportunities for your retirement goals.

Your Trusted San Antonio Real Estate Experts

Thinking about Moving to San Antonio or finding your perfect home in Boerne or the Texas Hill Country? The Gahm Real Estate Team is here to help. Whether you’re buying, selling, or just exploring your options, our local expertise ensures you get the best results Contact us today to turn your real estate goals into reality!