How to Buy a Home in San Antonio Without Waiting for Lower Mortgage Rates

Many homebuyers in San Antonio, Boerne, and across Texas are holding off on purchasing a home, hoping mortgage rates will drop. But is that the best strategy? According to leading market experts, rates may decline, but not as much as buyers hope. Here’s what you need to know to buy a home now—without waiting for rates to drop.

Will Mortgage Rates Drop Anytime Soon?

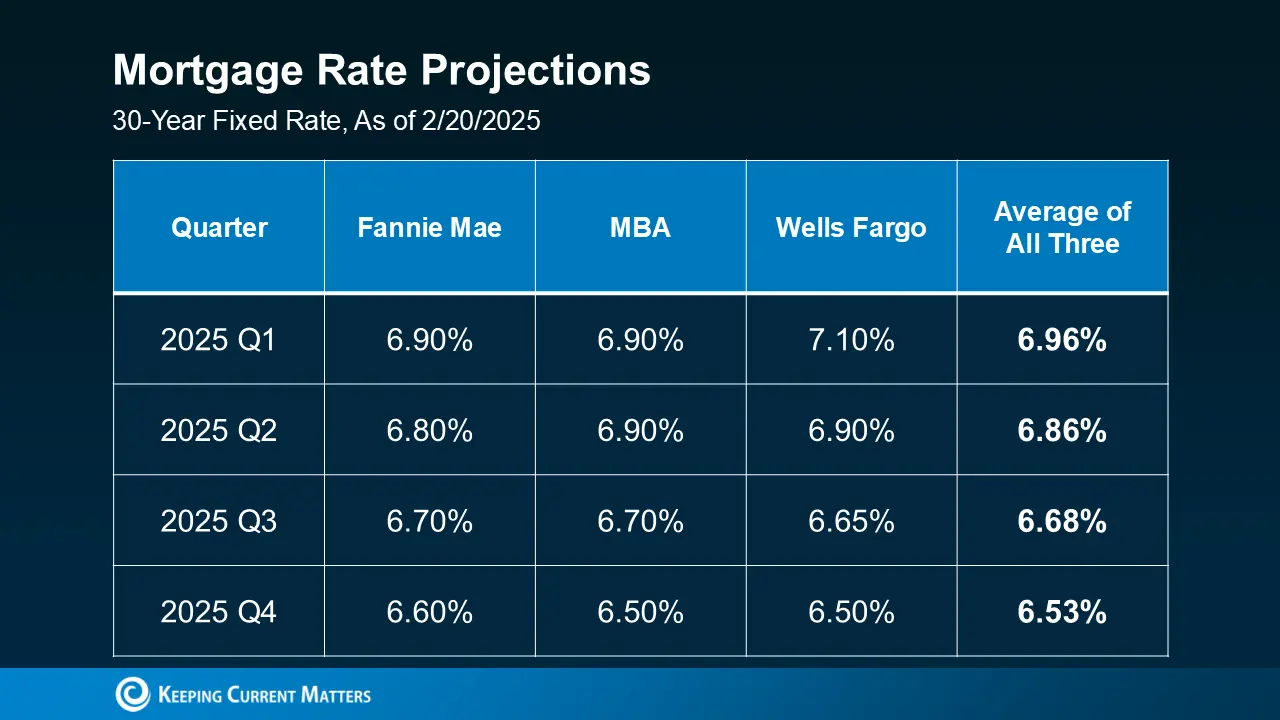

A few months ago, analysts projected mortgage rates could dip below 6% by the end of the year. However, new forecasts from from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo suggest rates are likely to stabilize between 6.5% and 7% instead. (see below)

If you’re waiting for a big drop in mortgage rates before buying a home in San Antonio, Boerne, or anywhere in Texas, you could be waiting a long time. And if you need to move due to a new job, a growing family, or life changes, delaying your purchase may not be practical.

Three Ways to Afford a Home in San Antonio Now

Instead of waiting, buyers in San Antonio should explore creative financing strategies to secure homeownership sooner. Here are three powerful strategies to discuss with your lender:

1. Mortgage Buydowns: Lower Your Interest Rate Now

A mortgage buydown allows buyers to pay upfront to lower their mortgage rate for a set period. This strategy is gaining popularity, with 27% of real estate agents reporting that first-time homebuyers are negotiating buydowns from sellers to afford houses for sale in San Antonio

1. Mortgage Buydowns: Lower Your Interest Rate Now

A mortgage buydown allows buyers to pay upfront to lower their mortgage rate for a set period. This strategy is gaining popularity, with 27% of real estate agents reporting that first-time homebuyers are negotiating buydowns from sellers to afford houses for sale in San Antonio

Key Benefits:

- Lower monthly mortgage payments initially

- Sellers may be willing to cover the cost

- Great for buyers expecting a future income increase

2. Adjustable-Rate Mortgages (ARMs):

If you’re looking for lower initial mortgage payments, an adjustable-rate mortgage (ARM) might be a great option. ARMs typically start with a lower interest rate than a traditional 30-year fixed mortgage, making them appealing—especially if you plan to refinance later or believe rates will drop in the future.

And if you remember the housing crash, don’t worry—today’s ARMs are much safer. Lance Lambert, Co-Founder of ResiClub, explains:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

In simple terms:

Back in the early 2000s, banks handed out ARMs without verifying whether buyers could afford them—which led to the housing market crash. But today, lenders require proof of income, assets, and employment before approving ARMs, making them a much less risky option than before

3. Assumable Mortgages: Lock in a Lower Rate

With over 11 million U.S. homes eligible, assumable mortgages allow buyers to take over the seller’s existing home loan—potentially at a much lower interest rate. This strategy is often overlooked but could save buyers thousands in interest costs.

Why Consider an Assumable Mortgage?

- Keep the seller’s low interest rate

- Potentially lower closing costs

- . Great for VA and FHA loan holders

– Find out if your dream home has an assumable mortgage—Contact us for a list of available homes for sale San Antonio!

Final Thoughts: Don’t Wait, Get Creative

If you’re considering buying a home in San Antonio, Boerne, or Texas, waiting for rates to drop could mean missing out on great deals. Instead, consider mortgage buydowns, ARMs, or assumable loans to make homeownership more affordable right now.

FAQs About Buying a Home in San Antonio Without Waiting for Lower Rates

1. Should I wait for mortgage rates to drop before buying a home?

While rates may decline slightly, experts predict they will stabilize around 6.5%–7%. Instead of waiting indefinitely, consider strategies like mortgage buydowns, ARMs, or assumable mortgages to make buying more affordable now.

2. What is a mortgage buydown, and how does it help?

A mortgage buydown allows you to pay upfront to lower your interest rate for a set period, reducing your monthly mortgage payment. Some buyers negotiate for sellers to cover the buydown cost, making it a great option in today’s market.

3. Is an adjustable-rate mortgage (ARM) a good idea?

An ARM loan offers a lower starting interest rate than a 30-year fixed mortgage. If you plan to refinance later or expect rates to decrease, an ARM can be a smart short-term option to save on interest.

4. What is an assumable mortgage, and how can it benefit me?

An assumable mortgage lets you take over the seller’s existing home loan—including their lower interest rate. With over 11 million homes eligible, this can be a powerful way to secure a better mortgage rate in today’s market.

5.Is San Antonio a good place to buy a home in 2025?

Yes! San Antonio real estate remains a strong investment due to its growing job market, affordable housing, and lower cost of living compared to other Texas cities like Austin. If you’re thinking about moving to San Antonio, now is a great time to buy before prices rise further.

Your Trusted San Antonio Real Estate Experts

If you’re Moving to San Antonio, Boerne, or anywhere in Texas, The Gahm Real Estate Team is here to make your transition seamless. . With deep local expertise and a passion for Texas real estate, we provide personalized service tailored to your needs. Whether you’re buying, selling, or exploring farm and ranch properties, we offer exceptional service and innovative marketing strategies to help you succeed.

Contact The Gahm Real Estate Team today and start your journey to homeownership in San Antonio!

🔹 Need expert advice? Schedule a consultation today!

🔹 Curious about your home’s value? Find out What’s Your Home Worth.

🔹 Explore available properties: View listings now.